Some Known Factual Statements About Beware “IRS Approved” Virtual Currency IRAs

Irish Republican Army - History, Attacks, & Facts - Britannica

Some Known Questions About Beware “IRS Approved” Virtual Currency IRAs.

Page Last Examined or Updated: 29-Apr-2022.

An IRA handbook on guerrilla warfare (1956)

An IRA is an account set up at a banks that permits a private to conserve for retirement with tax-free development or on a tax-deferred basis. The 3 primary kinds of Individual retirement accounts each have various advantages: - You make contributions with cash you may have the ability to deduct on your income tax return, and any profits can potentially grow tax-deferred up until you withdraw them in retirement.

Indicators on Irish Republican Army - Wikipedia You Should Know

- You make contributions with money you've currently paid taxes on (after-tax), and your cash may possibly grow tax-free, with tax-free withdrawals in retirement, offered that particular conditions are fulfilled. 2 - You contribute money "rolled over" from a certified retirement plan into this traditional individual retirement account. Rollovers include moving eligible possessions from an employer-sponsored strategy, such as a 401(k) or 403(b), into an individual retirement account.

Our Roth vs. Traditional individual retirement account Calculator can assist you identify an appropriate alternative. Why invest in Try This ? Many economists estimate that you may require approximately 85% of your pre-retirement earnings in retirement. An employer-sponsored cost savings plan, such as a 401(k), may not be adequate to collect the cost savings you require.

All about Individual Retirement Accounts (IRAs) - Fifth Third Bank

A Fidelity IRA can help you: Supplement your existing savings in your employer-sponsored retirement plan. Gain access to a possibly larger series of investment choices than your employer-sponsored plan. Benefit from prospective tax-deferred or tax-free development. You should try to contribute the maximum quantity to your IRA each year to get the most out of these savings.

Respond to a couple of questions in the IRA Contribution Calculator to discover whether a Roth or traditional IRA might be ideal for you, based upon just how much you're eligible to contribute and just how much you may be able to subtract on your taxes.

What Is The Irish Republican Army (IRA)? - YouTube

IRA: Understanding Your Individual Retirement Account for Dummies

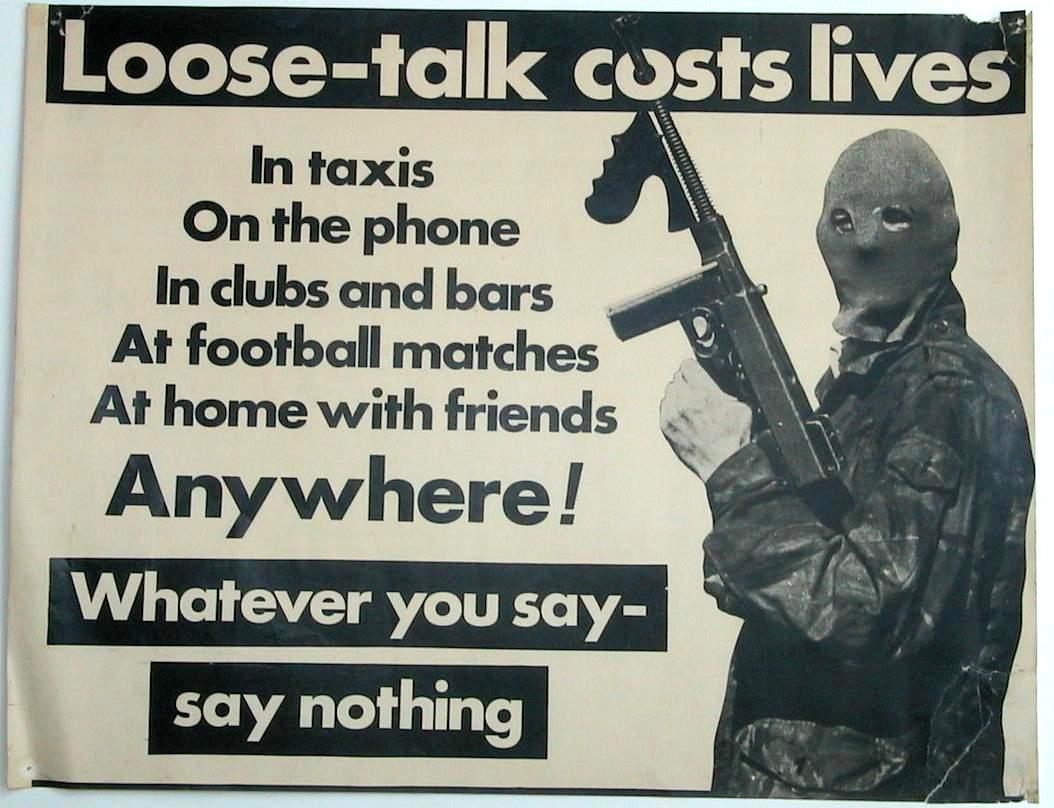

Irish republican innovative military organisation The Irish Republican Army (IRA) is a name utilized by numerous paramilitary organisations in Ireland throughout the 20th and 21st centuries. Organisations by this name have been dedicated to irredentism through Irish republicanism, the belief that all of Ireland should be an independent republic devoid of British guideline.